4 Investing Lessons From The Dramatic Collapse of Silicon Valley Bank

What can we learn from SVB going from > $15B market cap to ~ zero in less than a week?

Unless you live in the Bay Area or are a founder of a tech startup, you can be forgiven if you had never heard of Silicon Valley Bank until this week. And yet, it wasn’t some tiny local bank – in 2021 its market capitalization was $40B. On Monday its market cap was over $15B. By Friday morning, its shares were halted and the company was taken over by the Federal Deposit Insurance Commission (FDIC).

To quote King Theoden from Lord of the Rings: “How did it all come to this?”

First, a little history. SVB is known as the bank that serves the startup ecosystem centered on Silicon Valley. So it is no ordinary bank with a widely diversified roster of clients from various industries.

Furthermore, unlike most banks its business customers aren’t typically making money. In fact, until recently making money for a Silicon Valley startup was kind of a faux pas. Perhaps a sign that the founders weren’t aggressive enough or that the addressable market wasn’t that big.

So where do its customers get money to put in the bank? From their friendly Venture Capital (VC) backers who are much less interested in near-term cash flow than they are in a 10x-100x return to. These VCs are usually quite tolerant of the companies they back burning cash for some time.

So a startup business customer might put the money it raised from VCs into a SVB account. By the way, this amount frequently materially exceeds amounts insured by FDIC – keep this in mind, as this will become important later. That balance for each business might be declining as the company uses the funds to pay its employees. This can be offset by new startups opening accounts at SVB with a fresh dollop of VC money to burn.

You might ask, how did this venerable institution fare during the 2019 – 2021 Bubble? For that, let’s go straight to the CEO.

Analyst: Greg I wanted to start with a big picture view. In all of the years you've been doing this, have you ever seen the business this strong even dating back to the pre dotcom period?

CEO: Well, the straight answer is no.

- Q4 2021 Earnings Conference Call, October 2021

You can rest assured that the stock market took notice. A former colleague had warned me against investing in stocks with what he described as the “middle finger chart formation.” I am no chartist, but rather a fundamental value investor, so I will let you decide for yourself what, if anything, the chart of the stock price of Silicon Valley Bank reminds you of:

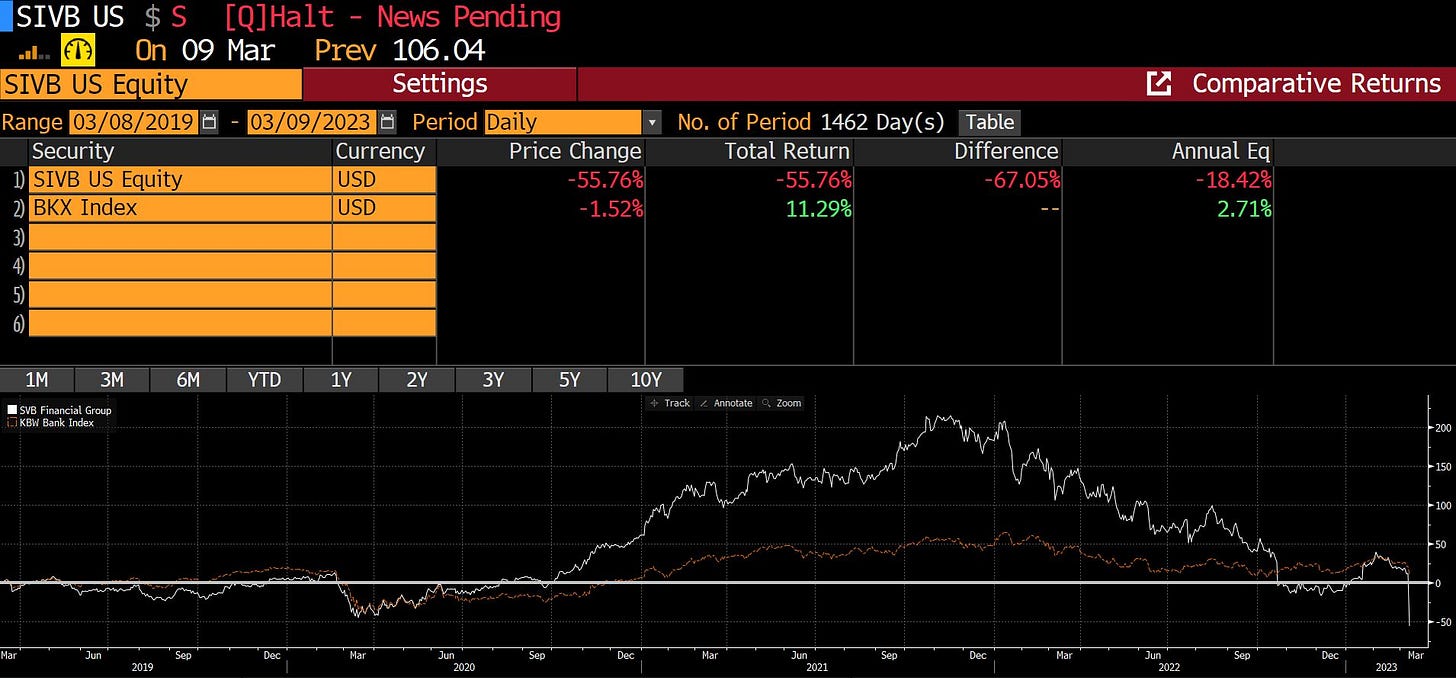

You might ask, but weren’t all banks doing really well during the boom times fueled by easy money and stock market animal spirits? Not nearly as well, as you can see when you compare the stock price of SVB with the KBW index of other banks:

In fact, the stock price of SVB had little in common with other banks. It did, however, have an eerie similarity with the basket of Bubble Stocks assembled by a lady named Cathie:

As you might have noticed, the Bubble is no longer in full swing. I am not sure it fully popped just yet, but the appetite for companies gushing red ink has certainly declined. Interest rates have risen. VCs started sending out stern letters to founders about cutting costs. There are even rumors of a possible recession floating around.

All of this is not exactly a fertile environment for funding new startups. So SVB isn’t getting that many newly-funded companies depositing their cash haul into its accounts. On the other hand, its existing customers continue to burn cash.

Fast forwarding to the Q4 2022 conference call conducted in January 2023, and the picture has changed quite a bit:

CEO: We're prepared if those things don't improve, again, which is important, and even if the market challenges are prolonged or get worse. It's important to note we have a high-quality very liquid balance sheet, which I know there will be lots of questions about; strong capital levels; a seasoned management team, with experience navigating challenging markets and adding a lot of new people with deep experience as well; and a consistent focus on our long-term business strategy. So when you put all that together, we feel clearly better about the outlook than we did last quarter, where there was more uncertainty.

[Later in the call]

CFO: In the quarter, from a balance sheet perspective on balance sheet, while we did see a decline in deposits, it was much lower than what we saw in the third quarter and the reason for that gets to what Greg mentioned as well as Mike, where we're seeing that lower level of cash burn.

Reading these statements one gets a picture of temporary adversity, but given the bank’s self-described “very liquid balance sheet” and a “seasoned management team” one might be forgiven for thinking that it’s all under control and nothing to worry about.

Even as recently as February 14th, 2023 at a financial conference where the CFO was presenting, we get the following exchange:

Analyst: I guess obviously you don't always provide intra-quarter updates. But as you think about how it's shaking out, fair to assume that it's kind of translating into a similar way in terms of when we think about the funding, both on and off balance sheet and how those dynamics are taking off?

CFO: Yes. I mean it's still obviously early in the quarter. But again the things to pay attention to are the expectations around venture deployment. And as we anticipated, we anticipated that, that would be a bit slower here in the first couple of quarters. So that, I think it is playing out.

[Later in the conversation]

Analyst: And anything around like just when you look at balance sheet composition and concentration like is concentration risk an issue? Or is that a factor at all?

CFO: We're always paying attention to it. But I think even though we're focused on technology, healthcare and life sciences, I think the diversification of the number of different specialties within those areas and just the vastness of how we do that on an international basis keeps us out of too much individual concentration, at least on the technology, healthcare and life sciences side.

When I was a young analyst at Fidelity Investments, they brought in former CIA officers to help train us in interviewing techniques. One thing that always stuck with me is that we were told that people often lie not by answering a question falsely, but by answering a question that’s different from the one being asked truthfully.

So if you were to ask a CFO of a bank “how is your balance sheet holding up?” and he were to answer “the thing to watch is X,” that should not leave you feeling like things are fine. Or if you were to ask him about diversification of customers and he were to tell you that they don’t have any undue individual customer risk, that doesn’t mean that they don’t have a high level of risk due to the high correlation between their customers’ financial profiles and drivers of cash flow.

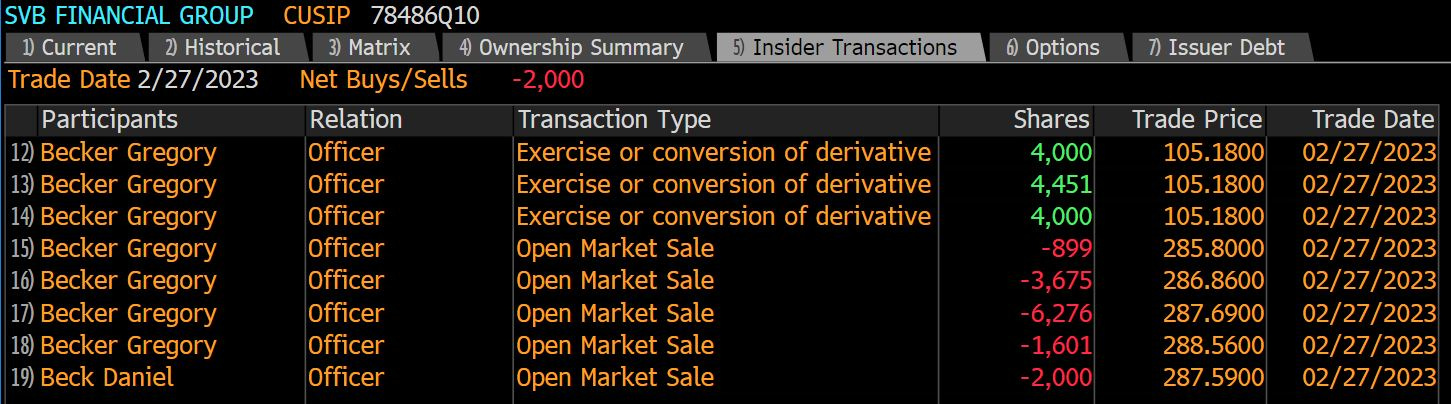

Interestingly, we don’t need to look just at management’s words. We can take a look at something else – insider stock transactions:

Allow me to decipher this for you. When management stock options vest, if they want to keep their shares they would at most sell enough to cover the taxes owed and keep the rest. That’s not what you see above. Despite their “high quality balance sheet” something made management want to cash in all of the vested shares. Normal personal diversification protocols, I am sure.

Which brings us to last week. On Thursday SVB announced that they needed to raise capital to offset losses on their securities portfolio. The stock price dropped by 60%. In one day.

You would think that of all people, the VC community would have a stake in keeping SVB alive and healthy. And you would be right. Then how would you interpret the following advice by one of the biggest VC names reported by Bloomberg on Thursday evening:

As normal prisoner’s dilemma behavior. Incidentally, according to news reports many VC firms gave their founders the same advice – move your money.

But what about FDIC insurance, you might ask? Wouldn’t that allay the startups’ concerns? Well, recall that most of the bank’s clients had deposits much larger than the amount covered by the FDIC. So if there were a run on the bank… they would lose their shirts.

So fear of a run on the bank led to… you guessed it, a run on the bank. SVB’s stock never opened on Friday. The FDIC took it over.

As for the kind-hearted VCs, they put out a statement, as seen here from a post on LinkedIn, where they professed their undying support and loyalty for SVB. As long as someone else ponies up the cash and they don’t risk any of their capital:

So what are the lessons for investors? I can think of 4:

Be wary of securities caught up in an extreme positive fundamental + market sentiment spiral unless you are very confident that the fundamental change is permanent.

Reflexivity, as coined by George Soros, is alive and well. Most of the time stock market prices gravitate towards intrinsic value. Sometimes, market prices for stocks can actually change intrinsic value. A run on the bank is a perfect example, as a lower stock price leads to lower customer confidence, which leads customers to take money out, which leads to a lower stock price, etc. Bear Stearns found out about this unpleasant phenomenon in 2008, and unfortunately it looks like the same fate befell SVB.

Never, ever, believe that things are fine just because management says they are fine and that they have everything under control. They will keep saying that right until the point when the company goes under. Not because they are bad people, but what do you really expect them to say? “We are on the precipice of doom if only things get a bit worse?”

Talk is cheap, so look at what management and other participants in the value chain are doing with their money. That will give you an insight into the real picture at the company.

I hope we find out next week that a deep-pocketed buyer was found, that the jobs of hard-working employees were saved and that the customers’ funds are safe. That is the right outcome for an institution that for decades helped the Venture Capital industry mint money. Unfortunately, I doubt that the common shareholders of SVB will see much, if any, of the $40B that the stock was valued at during the peak of the Bubble. Sadly, “caveat emptor” never gets old on Wall Street.

If you liked this article, please “like” and share this article.

About the author

Gary Mishuris, CFA is the Managing Partner and Chief Investment Officer of Silver Ring Value Partners, an investment firm that seeks to apply its intrinsic value approach to safely compound capital over the long-term. He also teaches the Value Investing Seminar at the F.W. Olin Graduate School of Business.